It is the most confusing time of the year; tax season!

Are you stressing about filling your personal and/or business taxes this year? The answer is probably yes. Well, I cannot do your taxes for you (it is difficult enough willing myself to get my own done) but I will gladly give you some pointers to make doing taxes yourself less daunting if you are filing in the USA. If you are not filing in the US, then you are welcome to join me on this informational jaunt but it is unlikely to aid you in your own filings.

If you have a CPA who you work with and pay to do your taxes, that is awesome and I envy you! You may still find this information helpful to understand what your CPA may need from you. For those of us who don’t have the means to hire a CPA or don’t think one worthwhile for our own tax returns, I am here to help where I can.

Get informed

All of the information you need to file your taxes is available on the IRS website. At this point you may be thinking, “Yeah, that website may as well be an ancient Elven text.” Hear me out…

The IRS website can be unbelievably daunting, I admit, but the IRS is actually trying to make things easier for the average human. The searchability has been enhanced and there are many embedded links to help you jump right to the info you need.

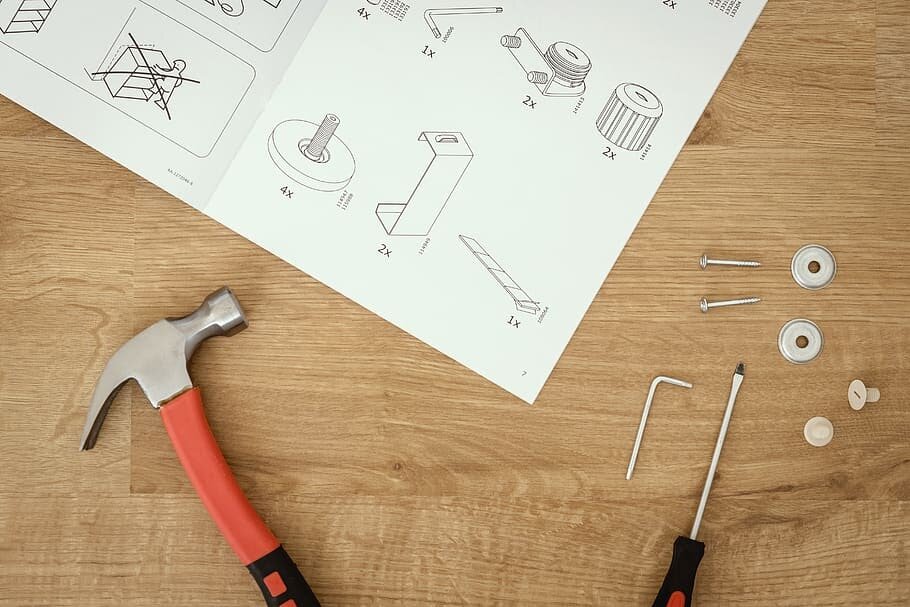

The key is to think of the lengthy site pages as the instructions to some furniture you purchased online.

You will not need all the instructions if they do not apply to you. Just like with the furniture assembly instructions; if you did not purchase the add-on listed on page 5, skip it. There will be many rules or definitions listed on each page but there are handy links that let you skip right to the parts that you actually need to know.

Fear not the navigation

You may need to do a few searches to find the page/info/form that you need. Embrace that. Take a deep breath and know that you will need to do a fair amount of prep work before getting to your actual filing.

-

Filing for your business but not sure where to start? Find the different business filing types on this IRS webpage. You will find the definitions of the businesses plus a link to the rules for each type.

-

If you are a business owner or partner, you likely want to know how to deduct your business expenses, and that IRS page is here.

-

There is even a Small Business Workshop with video presentations to help you along.

-

There is a even page for dealing with your gig income that may not fit with the traditional business types.

-

Just filing as an individual? There is a page for you too! Your filing may be free and the form, although long, does have directions that you can access.

Many people pay for tax filing software. I have had good experience with some software for my personal use but have not attempted it for business purposes so I cannot comment on the effectiveness. There are also services that you can hire to help you file that are less expensive than hiring a CPA. If you can spare the funds and do not want to do the legwork, those are great options. I do advise that you research a little bit in both of these cases as a software is limited and individuals vary in their level of expertise. Consider your options, get informed and decide what will work best for you.

Filing your taxes may not be a “piece of cake” with these tips, but I hope that I have armed you with some knowledge and confidence to get yours started.